Economic Commentary

Published: November 2020

Our monthly update on Scottish and Angus economic trends and performance, drawn from a wide range of economic indicators and statistics.

Overview

- The Scottish Government August Monthly Economic Brief highlights the scale of the economic shock in Scotland but also points to evidence of stabilisation as parts of the economy reopen.

- Scottish economic output may not return to pre-crisis levels until 2023

- The extent of the impact on Scotland’s labour market is only starting to emerge and our unemployment rate could increase to around 8% as Government support (e.g. the furlough scheme) is reduced

- Scotland’s exports are notably lower than last year

- Business optimism is improving, activity is stabilising, but overall demand remains subdued

- The brief notes 3 main risks to Scotland’s recovery:

- Businesses operating at reduced levels of capacity and staffing

- The potential impact on the economy as support schemes are unwound

- A resurgence of COVID-19 cases leading to re-imposed lockdowns and/or slower return of demand

The Scottish Government’s latest State of the Economy report was published in September. The headline information states:

- GDP should continue to recover into the third quarter, however there is greater uncertainty about what might happen to output in the fourth quarter

- The main risks are from a potential second wave of coronavirus, further restrictions, as well as a possible failure to agree a trade deal with the EU

- Even as the economy recovers, the impacts of coronavirus on activity are increasingly being felt differently across sectors

- Trading conditions for some sectors remain extremely challenging with many operating at reduced capacity and facing ongoing cashflow challenges

- Analysis shows Scotland’s economic output could fall 9.8% in 2020, with global economic uncertainty remaining elevated

Gross Domestic Product (GDP) is one of the most important measures of economic activity, in simple terms the value of all output in an area.

In August, Scotland’s GDP is provisionally estimated to have increased by 2.6% compared to last month. This is the fourth consecutive month of increasing GDP following the large drops in March and April but represents a slowdown.

GDP remains 9.4% below the level in February, prior to the impacts of Covid-19. Compared to the lowest point in April, around 60% of lost output has been recovered.

In August there has been a more uneven pattern of growth among the main sectors of the economy.

- Services output increased by 3.3% but remains 10.3% below its February level.

- Production output fell by 0.3%, and remains 5.6% below its February level, and

- Construction output increased by 3.8% but remains 9.4% below its February level.

Read the Scottish Government GDP Report for August 2020.

Business Impact of Coronavirus (COVID-19) Survey (BICS) Scotland Estimates Wave 13

The latest main findings for businesses with 10+ employees and a presence in Scotland for the period 7 – 20 September showed that:

The share of businesses ‘currently trading’ was estimated at 95.5%. This rate varied by industry sector – with lower rates for Accommodation & Food Services (82.7%) and Arts, Entertainment & Recreation (92.4%). It should be noted that those businesses not currently trading may be less likely to complete the survey and these numbers may be an overestimate.

The share of businesses with any staff on furlough leave was estimated at 59.8% in the period 24 August to 20 September 2020.

The share of the workforce on furlough leave was estimated at 13.8% in the period 24 August to 20 September 2020. This rate varied by industry sector – with markedly higher rates for Arts, Entertainment & Recreation (56.7%) and Accommodation & Food Services (40.9%).

The share of the workforce working remotely, instead of at their normal place of work, was estimated at 26.4% in the period 24 August to 20 September 2020. This rate varied by industry sector – with markedly higher rates for Information & Communication (69.1%) and Professional, Scientific & Technical Activities (57.1%).

There were 4 industries where more than half of their businesses experienced a decrease in turnover compared with what is normally expected for this time of year. These were the Accommodation & Food Services (75.6%), Arts, Entertainment & Recreation (72.4%), Transport & Storage (55.5%) and Manufacturing (51.1%).

The latest Scottish labour market data (June – August) shows:

The employment rate in Scotland was 73.9%. This is 0.4% up on the quarter and 0.4% down on the year.

The unemployment rate in Scotland was 4.5%. This is no change on the quarter and 0.4% up on the year.

The inactivity rate in Scotland was 22.6%. This is 0.4% down on the quarter and 0.1% up on the year.

Summary of latest headline estimates for regions of the UK, June to August 2020

Source: Office for National Statistics – Labour Force Survey

The Furlough Scheme means much of the unemployment associated with Covid-19 may have been delayed rather than avoided – e.g. the latest Scottish Business Monitor suggests that more than half of Scottish businesses (55%) are planning to make some reduction in staff numbers as the furlough scheme is wound down.

Skills Development Scotland have developed a COVID-19 Labour Market Insights series providing up-to-date evidence on the impact on Scotland’s economy, business and people. It includes spotlights on specific sectors and regions and also summarises the key challenges alongside the ongoing response from SDS.

Claimant Count, August and September 2020: The number of people on Universal Credit and Jobseekers Allowance in Scotland fell by 1.3% between August and September. The degree of recovery has varied amongst Scottish local authorities. Despite a recovery experienced across most of Scotland, Shetland Islands, Aberdeen City, Aberdeenshire, Angus, and Dundee saw the number of claimants rise.

Source: Fraser of Allander (23/10/2020), Latest data on the Scottish economy.

Claimant count by age – not seasonally adjusted (Sept 2020)

Source: ONS Claimant count by sex and age

Note: % is number of claimants as a proportion of resident population of the same age.

Unemployment benefit claimant count in Angus increased by 98.3% between January and August 2020.

Job vacancies

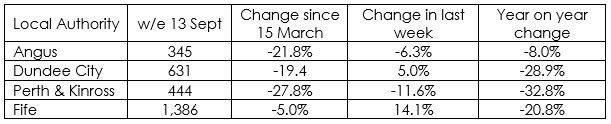

The table below shows the number of job vacancies in each local authority. Vacancy levels in Angus have had the least reduction year on year compared to neighbouring authorities. This may be due to the sectoral structures of each local economy.

Institute for Employment Studies published vacancy analysis in response to Covid-19.

Regional variations

Given the variation in sectoral impacts of the pandemic, there is some disparity among the effects of the pandemic on local authorities.

Shetland Islands, Inverclyde, and Falkirk were most likely to be among the hardest hit Scottish local authorities due to their heavy reliance on sectors most exposed to lockdown – i.e. the transportation and storage sector (circa 20% of GVA in Shetland Islands and Inverclyde). East Renfrewshire, Moray and Aberdeenshire are more reliant on sectors where the shock to output has been less significant. The faster pace of reopening after the lockdown of some sectors relative to others has also contributed to a divergence in developments amongst Scottish local authorities.

Angus council’s Invest in Angus team issued a business survey in July. There were over 300 responses.

11.6 % of businesses had already made staff redundant. 34% have furloughed staff, and only 22.1% of companies have cash reserves of more than 6 months.

The following were the main future concerns for companies should COVID-19 restrictions were to continue over the next 3 to 6 months:

Of the 34% of companies that had furlough staff, 82.7% had furloughed staff across all their jobs/occupations.

48.5% of companies did not anticipate being able to continue paying staff once the furlough scheme reduces or ends.

As companies begin to plan their re-opening, only 55.1% expected to require over 75% of their employees in the first 3 months. 14.6% of companies expected to need less than one quarter of employees.

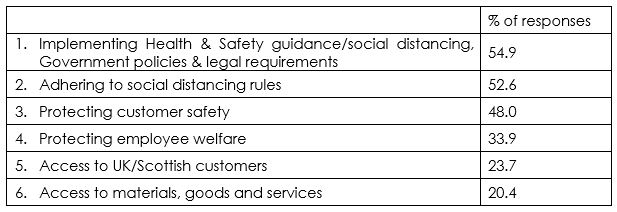

Companies saw the main challenges to restarting their businesses as:

Of companies who were planning to shift their business model as they restarted, the main shift was towards more online sales or direct delivery to customers (18.1%). This is followed by increased partnership working with other businesses (17.1%), and diversification and targeting new customers in the UK (13.2%).

Dundee & Angus Chamber of Commerce Quarterly Economic Indicator Survey Q 3 2020

The survey highlighted that Covid-19 has forced 38% of local businesses to make changes to their products & services.

- Average operating capacity in Dundee & Angus businesses has improved from 54% to 69% quarter on quarter.

- Over the last 3 months businesses are significantly more concerned about taxation and exchange rates.

- 47% of businesses expect prospects to improve over next 12 months, but 7% are concerned they may not survive.

Dr Shona Dobbie, Angus Economics commented “Being able to create our own business sentiment index is a huge step forward as it provides a wealth of information about the conditions local businesses are actually facing and their expectations for the next few months. The information used in calculating the index lets us see not only what is going well but also where the pinch points are at any point in time, and this gives us the ability to be much more pro-active.”