Economic Commentary

Published: December 2020

Our monthly update on Scottish and Angus economic trends and performance, drawn from a wide range of economic indicators and statistics.

Overview

The Scottish Government October Monthly Economic Brief covers Q3 2020.

The path of recovery continued to differ by sector as local restrictions influenced the level of economic activity in some sectors.

The latest Purchasing Managers Index signalled that slower growth continued into September with the Services sector in particular reporting only marginal growth.

As the economy continued to transition from national lockdown, Government support remained a critical factor in helping businesses to retain jobs and provide flexibility during this period in which many businesses have needed to operate below capacity.

At the end of August, 242,600 employments in Scotland were on furlough, supporting the unemployment rate to remain low at 4.5% in June to August. However, the claimant count remained 8% in September, with payrolled employments around 63,000 lower than last year, emphasising the underlying challenges.

Unemployment is expected to rise as the furlough scheme is replaced by the Job Support Scheme. However, the latest changes to the scheme should result in a more limited negative impact than initially feared.

This has an important feed through to expectations for consumption in the final quarter of the year, particularly in the lead up to the festive season which is so important for the retail sector. Retail sales remain significantly down on last year, however have continued to stabilise in recent months.

The Scottish Government’s latest State of the Economy report was published in September. The headline information states:

- GDP should continue to recover into the third quarter, however there is greater uncertainty about what might happen to output in the fourth quarter

- The main risks are from a potential second wave of coronavirus, further restrictions, as well as a possible failure to agree a trade deal with the EU

- Even as the economy recovers, the impacts of coronavirus on activity are increasingly being felt differently across sectors

- Trading conditions for some sectors remain extremely challenging with many operating at reduced capacity and facing ongoing cashflow challenges

- Analysis shows Scotland’s economic output could fall 9.8% in 2020, with global economic uncertainty remaining elevated

Gross Domestic Product (GDP) is one of the most important measures of economic activity, in simple terms the value of all output in an area.

Scotland’s GDP increased by 1.6% in September but remains 7.6% below February.

In September there has been growth in all of the main sectors of the economy, but at a slower rate than seen over the summer months.

Output in the sectors is reported to have increased as follows – compared to August: services (1.6%), production (1.4%), and construction (2.7%).

Business Impact of Coronavirus (COVID-19) Survey (BICS) Scotland Estimates Wave 13

The latest main findings for businesses with 10+ employees and a presence in Scotland for the period 7 – 20 September showed that:

The share of businesses ‘currently trading’ was estimated at 95.5%. This rate varied by industry sector – with lower rates for Accommodation & Food Services (82.7%) and Arts, Entertainment & Recreation (92.4%). It should be noted that those businesses not currently trading may be less likely to complete the survey and these numbers may be an overestimate.

The share of businesses with any staff on furlough leave was estimated at 59.8% in the period 24 August to 20 September 2020.

The share of the workforce on furlough leave was estimated at 13.8% in the period 24 August to 20 September 2020. This rate varied by industry sector – with markedly higher rates for Arts, Entertainment & Recreation (56.7%) and Accommodation & Food Services (40.9%).

The share of the workforce working remotely, instead of at their normal place of work, was estimated at 26.4% in the period 24 August to 20 September 2020. This rate varied by industry sector – with markedly higher rates for Information & Communication (69.1%) and Professional, Scientific & Technical Activities (57.1%).

There were 4 industries where more than half of their businesses experienced a decrease in turnover compared with what is normally expected for this time of year. These were the Accommodation & Food Services (75.6%), Arts, Entertainment & Recreation (72.4%), Transport & Storage (55.5%) and Manufacturing (51.1%).

The latest Scottish labour market data (July – September) shows:

Summary of latest headline estimates for regions of the UK, July – September 2020

The Furlough Scheme and its successors mean much of the unemployment associated with Covid-19 may have been delayed rather than avoided. In his Spending Review of 25/11/2020, Chancellor Rishi Sunak predicted that official forecasts predict the biggest economic decline in 300 years. The UK economy is expected to shrink by 11.3% this year and not return to its pre-crisis size until the end of 2022. Government borrowing will rise to its highest outside of wartime to deal with the economic impact.

The government’s independent forecaster, the Office for Budget Responsibility (OBR) expects the number of unemployed people to surge to 2.6 million by the middle of next year. (Source: BBC News, 25/11/2020, Rishi Sunak warns ‘economic emergency has only just begun’)

Skills Development Scotland has developed a COVID-19 Labour Market Insights series providing up-to-date evidence on the impact on Scotland’s economy, business, and people. It includes spotlights on specific sectors and regions and also summarises the key challenges alongside the ongoing response from SDS.

Unemployment benefit claimant count in Angus increased by 84.6% between January and October 2020.

Claimant count by age – not seasonally adjusted (Oct 2020)

Source: ONS Claimant count by sex and age

Note: % is number of claimants as a proportion of resident population of the same age

Unemployment in Angus fell from 5.8% in September to 5.5% in October.

Unemployment in Scotland fell from 6.3% in September to 6.0% in October.

Unemployment in GB fell from 6.5% in September to 6.3% in October.

Job vacancies

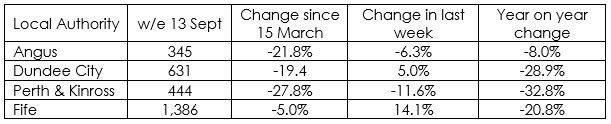

The table below shows the number of job vacancies in each local authority. Vacancy levels in Angus have had the least reduction year on year compared to neighbouring authorities. This may be due to the sectoral structures of each local economy.

Source: ONS Claimant count by sex and age

Note: % is number of claimants as a proportion of resident population of the same age.

Unemployment benefit claimant count in Angus increased by 98.3% between January and August 2020.

Job vacancies

The table below shows the number of job vacancies in each local authority. Vacancy levels in Angus have had the least reduction year on year compared to neighbouring authorities. This may be due to the sectoral structures of each local economy.

Institute for Employment Studies published vacancy analysis in response to Covid-19.

Regional variations

Given the variation in sectoral impacts of the pandemic, there is some disparity among the effects of the pandemic on local authorities.

Shetland Islands, Inverclyde, and Falkirk were most likely to be among the hardest hit Scottish local authorities due to their heavy reliance on sectors most exposed to lockdown – i.e. the transportation and storage sector (circa 20% of GVA in Shetland Islands and Inverclyde). East Renfrewshire, Moray and Aberdeenshire are more reliant on sectors where the shock to output has been less significant. The faster pace of reopening after the lockdown of some sectors relative to others has also contributed to a divergence in developments amongst Scottish local authorities.

The information below while not specifically giving details on business impact does give an insight on the extent to which business are able to adapt to new restrictions, such as the ‘work from home if possible’ order. Many businesses have been able to adapt their business models in response to these trends. Travel restrictions. Supply chain length and buy local campaigns have all had an impact on football, differing vastly between local authorities.

Google Footfall Data

Retail and recreation footfall fell across Scotland by 73% between February and April 2020. Since then it has steadily increased and in September was around 7% lower than in February.

Some Councils have footfall at higher levels than in February, Argyll and Bute (25.5%) and Highland (16.2%) are especially high.

In contrast, some areas, including Edinburgh (-31.6%) and Aberdeen (-34.3%), still have much lower footfall levels than usual.

The chart below shows the changes in retail footfall for all local authorities between February and September 2020.

Source: Covid-19 Supplement to SLAED Indicators Report 2019-20

Work from Home Estimates

In Scotland just over 39% of jobs can be done from home, which is lower than the 44.6% in the UK as a whole. This is due to a higher proportion of non-teleworkable jobs in Scotland.

In both Scotland and the UK, shop sales assistants is the most common occupation. Tthis accounts for a higher proportion of jobs in Scotland at 4.2% than in the UK at 3.4%.

This varies between local authorities, with Edinburgh, East Renfrewshire, East Dunbartonshire, and East Lothian all having rates of teleworkable occupations higher than the Scottish and UK averages. Orkney Islands, Moray, Angus, Eilean Siar, and Highland Councils have the lowest proportions of jobs that can be done from home at under 35%.

The chart below shows the percentage of jobs within each local authority area that can be worked from home.